Part 9 Debt Agreement Home Loans

Debt agreements cover most unsecured debts such as. Nmoni on the other hand are able to offer car loans with Part 9 to clients who have demonstrated an ability to meet commitments.

A debt agreement is one of two agreement options available.

Part 9 debt agreement home loans

. A Part 9 debt agreement is available to low-mid income earners who are unable to pay what they owe to their creditors but also want to avoid bankruptcy. My partner entered a part 9 debt agreement of 40000 at the end of last year2012 and started making payments in janfeb 2013. Unsecured personal loans and pay day loans.A debt agreement also known as a Part IX debt agreement is a formal way of settling most debts without going bankrupt. In a Debt Agreement you pay a percentage of your combined unsecured debt. A debt agreement also known as a Part IX 9 is a legally binding agreement between you and your creditors.

Medical legal accounting fees. Your creditors agree to receive an amount of money that you can afford to pay back down to 60 of the original amount owing. As home loan experts we highly recommend you hold off applying for finance during your Debt Agreement.

So what exactly is a Part 9 Debt Agreement. However it will be extremely difficult for you to be found eligible for finance until you have been discharged from your DA. A Part 9 Debt Agreement is an alternative to full bankruptcy and is formed between you and your creditors via an administrator when you cannot afford to repay your debts.

Debts you may be liable to pay include. The maximum amount of unsecured debt that you can roll into a debt agreement is currently 11334960. Debt agreements are a legally binding type of personal insolvency separate from bankruptcy for those debtors with relatively small debts low incomes and little property.

Therefore this automatically makes you a h igh risk borrower to lenders. Loan amounts that are available for those in a part 9 debt agreement can be anywhere from 1200000 to 2500000 there are a few factors that will determine how much you can get which will be based on your overall profile how much surplus income you have that can be used for the repayments after all liabilities have been deducted how long you have been in your job and which one of the. Due to this many lenders may be unwilling or unable to provide a suitable car loan.

Germanys 1 Fee-Free Independent Mortgage Broker Advisor. Applying for a home loan with a Part 9 debt agreement You can apply for a home loan when you are under a debt agreement but it may be difficult to get approval. It is extremely important for you to behave cleanly and flawlessly in managing your finances before applying for a home loan.

Advertentie German Mortgage Broker Made for Expats Check Your Options Talk to One of Our Experts. Overdrawn bank accounts and unpaid rent. A debt agreement can be a flexible way to come to an arrangement to settle debts without becoming bankrupt.

Its not a consolidation loan or an informal agreement with your creditors. A home loan under a Part 9 debt contract has higher interest rates than a standard home loan. Once the debt agreement is payed off he will have no debt owing nor do i have any debt.

Gas electricity phone and internet bills. Credit and store cards. Part 9 Home Loans - You have bad credit but your part 9 debt agreement is over or your defaults are greater than 12 months old.

How Part 9 Debt Agreements work. A Part 9 Debt Agreement is a binding agreement between you and your creditors under the Bankruptcy Act 1966. Its an agreement between you and your creditors that is whoever you owe money to.

A banks main objective is to generate profits and reduce risk. It is a legally binding contract that your creditors will accept the amount of money that you can afford to pay over a period of time to settle your debts. A Part 9 Debt Agreement is considered as an act of bankruptcy by lenders and banks.

What is part 9 debt agreement. Generally interest and fees are also waived. Part 9 Debt Agreements while currently active on your credit file will not allow you to purchase a home.

A debt agreement is for people on. While a Part IX can be a preferable alternative to bankruptcy it can affect any future applications for finance including home loans. The debt agreement will be paid off in less then two weeks which will be late november 2013 in this time frame he has also managed to pay off his 28000 car loan and has bought a new car out right for 25000.

If you a looking for a home loan you will learn very quickly that most banks prefer to deal with borrowers who have a perfect credit history. It tells the lender that you have had issues making loan repayments in the past. The extent to which a Part IX affects an application depends on many factors including your wider financial and personal circumstances.

Lenders consider a debt agreement as an act of bankruptcy that shows youve had problems paying back loans previously making you a. There is no law against you applying for finance of any kind including home loans during your Part 9 Debt Agreement. Your application for prior authorization is filed with a specialized mortgage lender and not with a large bank.

A Part 9 Debt Agreement simply referred to as a Debt Agreement is a legally binding agreement arranged by a third party called a Debt Agreement Administrator between you and your creditors.

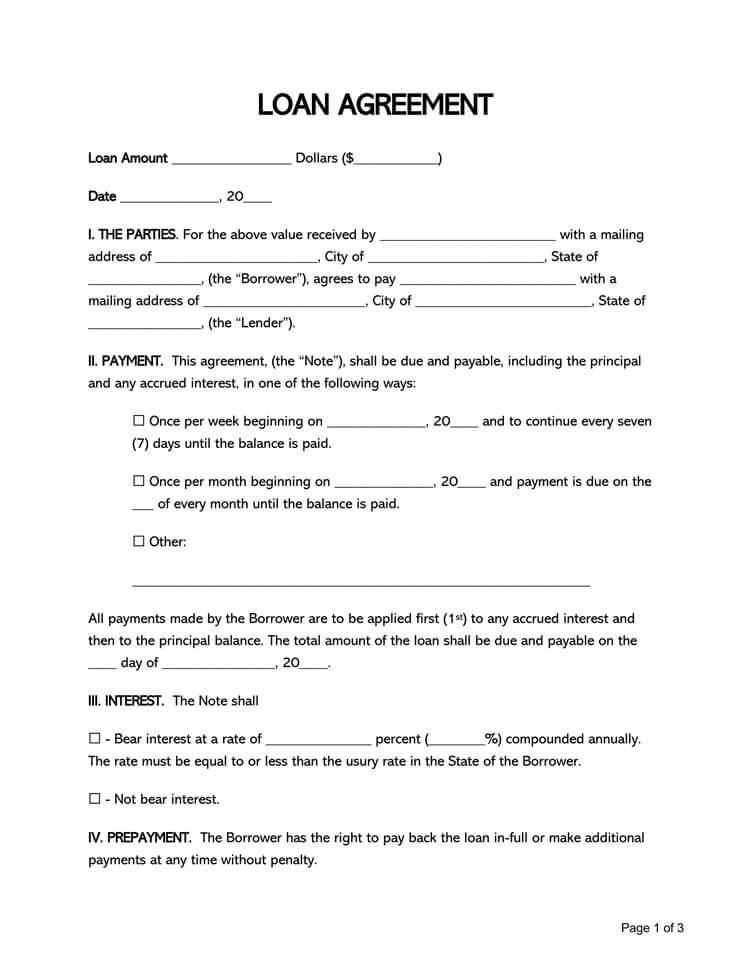

Pin On Examples Contract Templates And Agreements

38 Free Loan Agreement Templates Forms Word Pdf

Printable Loan Agreement Car Payment Personal Loans Contract Template

Post a Comment for "Part 9 Debt Agreement Home Loans"