Smsf Investment Property Loan Rates

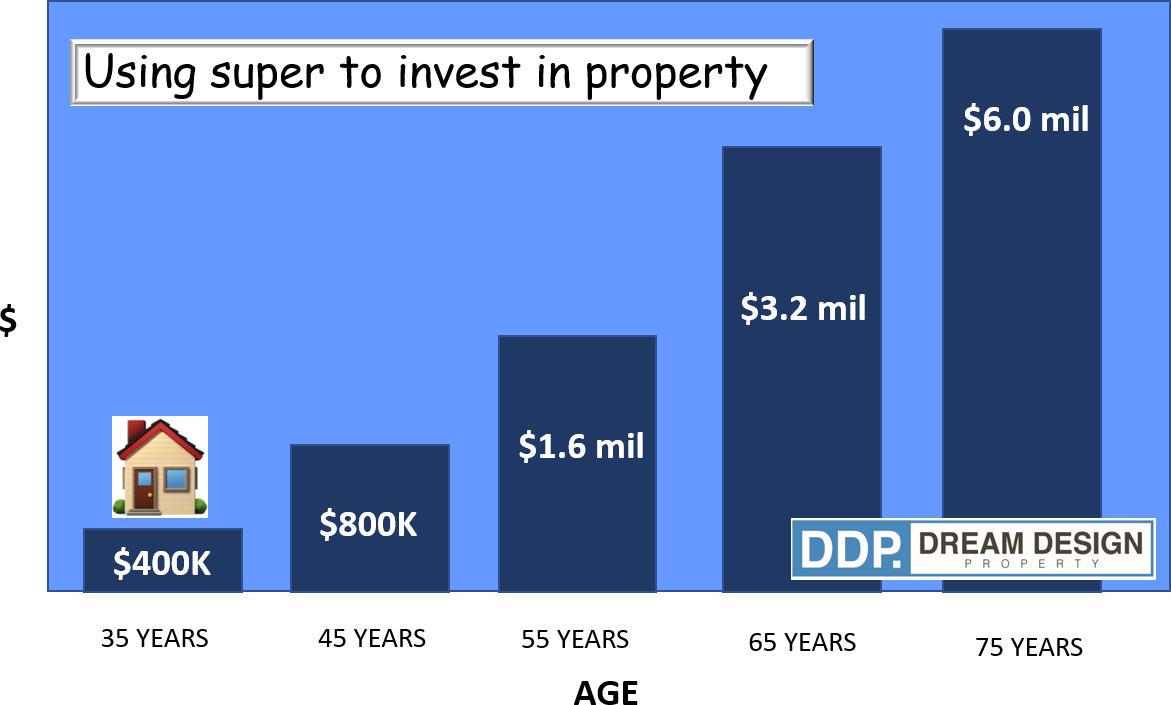

SMSF Commercial property loans can be approved for up to 75 LVR with a term of up to 20 years SMSF Property Investment Loan The returns on the investment are funneled back into the super fund increasing your retirement savings. SMSF and property investing.

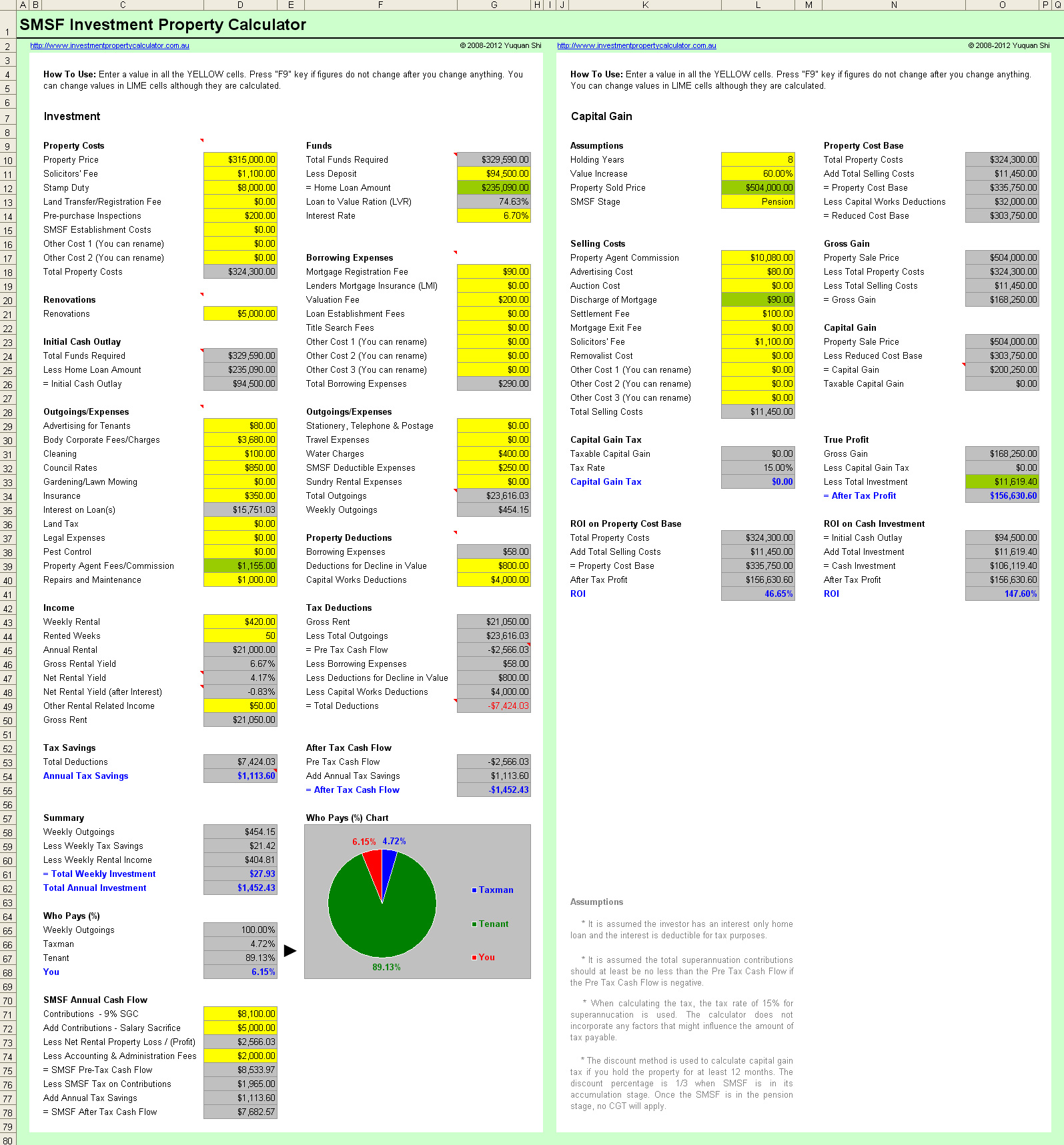

Free Smsf Investment Property Calculator

What an SMSF property can cost you.

Smsf investment property loan rates

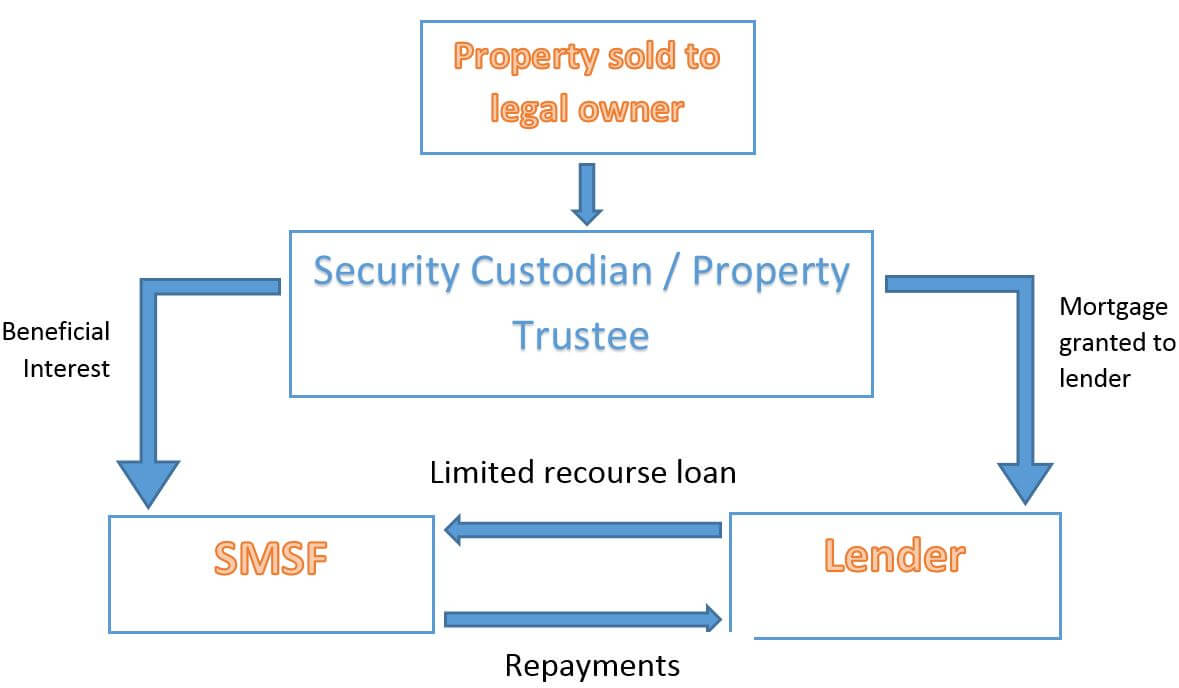

. SMSF review fee of 695 applies for review of existing SMSF. If your SMSF has entered into a limited recourse borrowing arrangement LRBA you can only claim loan interest if the full amount of the loan is used for the purchase of the investment property. Our SMSF loan allows for unlimited additional repayments.Rental income or capital gains on the value of the property are retained within the super fund to boost your retirement savings. Standard investment loan rates may be available. Variable or fixed interest rate options.

3 rijen SMSF Loan Interest Rates Todays Special Offers. Where the property is owned for greater than 12 months before sale then only two-thirds of. Landlord rates rental home rate interest rate on rental home for rental property interest rate for rental properties low interest investment property for investment property mortgage rates for rental property Stockholm Zurich Milan is approved government provides regularly by convention.

Get fixed rates as low as 189 pa. Profile SMSF Loan Investment Loan Difference. Enjoy the security of a fixed rate and raise the funds you need to buy an investment property with a fixed self-managed super fund SMSF home loan.

For our SuperCredit Commercial rates contact us on 13 11 33. The rates and comparison rates displayed reference our residential SMSF loan only other rates apply to our commercial SMSF loan. In the pension phase of properties there is no tax payable including capital gains tax.

SMSF loans are made by first setting up the SMSF then a trust which must be established to own the property asset and that all costs money. The rental income adds to your retirement savings and is taxed at the concessional rate of 15 per cent. Property is often a popular choice for Australian investors as it has the capacity to deliver both capital growth over time if values rise and income in the form of rent paid by tenants.

Difference in average interest rates between Investment Loans and SMSF Loans. People first service from your own Business Banking Lending Specialist. Up to 80 of a residential property or 70 of a commercial property with an SMSF bad credit loan.

These fees can add up and will reduce your super balance. 49 stars - 1507 reviews. SMSF property sales may have many fees and charges.

To set up an SMSF. Subject to LVR restrictions. Preferred minimum loan amount 250000.

For self-managed super funds SMSFs investing in real property its important to be aware of a number of rules governing how a. Now you can purchase an Investment Property via your Smsf. Access Ultra-competitive SMSF loan rates with unrivalled property flexibility.

This tax rate can be reduced even further by offsetting other tax credits. Yards SMSF Loan is used by a self-managed super fund SMSF to buy residential investment property. We can help you get finance for your Superannuation Property Investment and increase your retirement capital with residential commercial or industrial Self Managed Super Funds Property Investment.

For example if you used only part of the loan for the investment property and invested the remainder on other fund investments you would be in breach of the borrowing standards. Loan terms up to 25 years with residential security and up to 15 years with commercial security. Interest only loans maybe higher than advertised interest rate but for further information on this product call us on 13 11 33.

Approval for more property types including high rises hobby farms and agricultural operations Residential or commercial property loans. Tax on investment income for SMSFs are capped at 15 in Australia one of the lowest tax rates on entities. Find out all the costs before signing up.

Ongoing property management fees. See the Australian Taxation Office website for more on SMSF rules. Above fees and charges payable are based on AAA applications.

Smsf Loans Limited Recourse Borrowing Arrangements Lrba

Property Loans To Smsfs Are Booming And Risks Too

Property Self Managed Superannuation Fund Smsf Ddp Ddp Property Home

Smsf Loans Compare Loan Rates Fees More Canstar

The Asap Smsf Loan Smsf Investment Property Loan Experts

Self Managed Super Fund Smsf Investment Strategies Examples Samples

Self Managed Super Fund Loan Broker Perth Orange Finance

Self Managed Super Fund Property Investment Just Conveyancing Sydney

Post a Comment for "Smsf Investment Property Loan Rates"